how to use tax exempt at lowes

Select Tax Exemptions under the Account Details section. Let us know and well give you a tax exempt ID to use in our stores and online.

As of January 5 2021 Form 1024-A applications for.

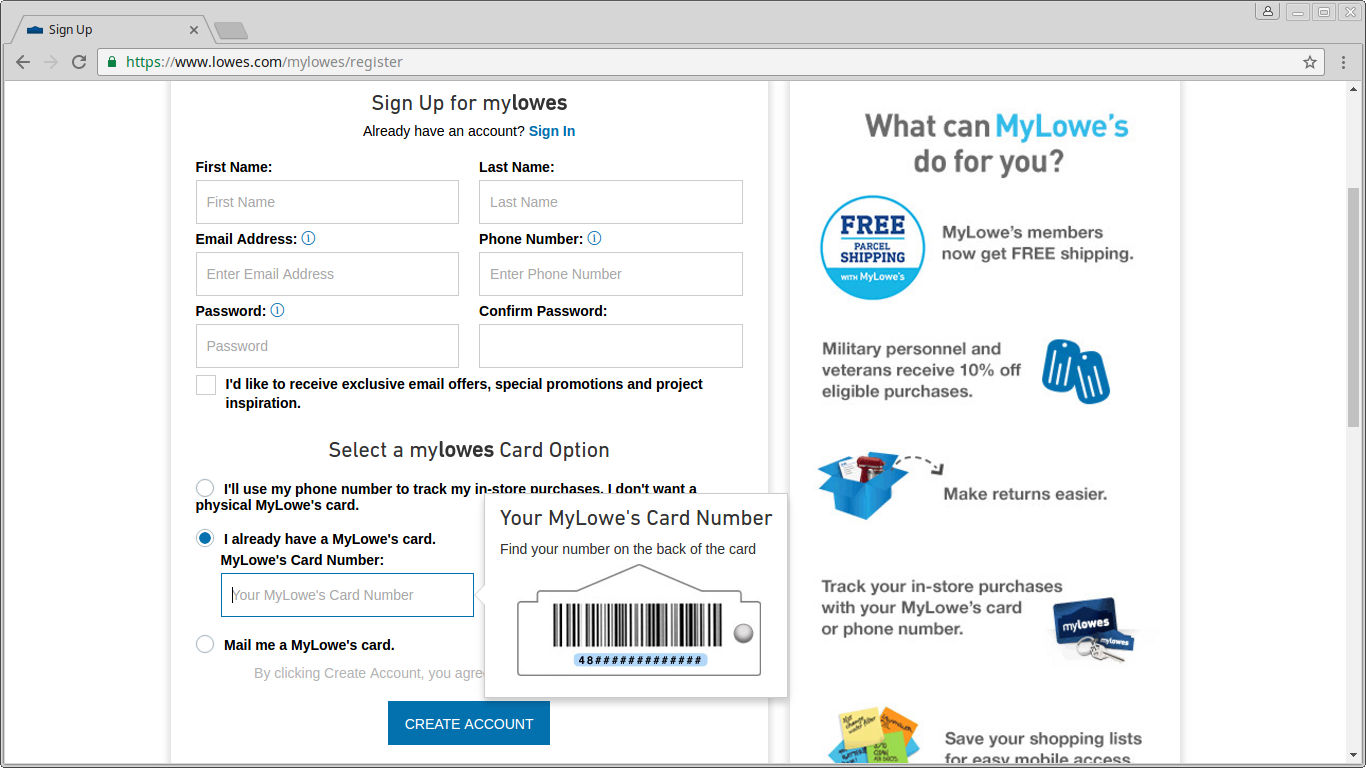

. Have your local lowes store provide you with your lowes customer id or lowes tax id. Have your local lowes store provide your lowes customer id or lowes tax id. Tax-Exempt Management System TEMSSelect Sign In or Register in the top right cornerOnce signed in select My Account in the top right corner of the search barSelect Organization and then select Tax ExemptionsHave your local Lowes store provide your Lowes customer ID or Lowes tax IDMore items.

The Amazon Tax Exemption Wizard takes you through a self-guided process of enrollment. How do I register as tax exempt Get a Lowes Tax. Use of Sales Tax Exempt Forms.

Lowes use only streamlined sales and use tax certificate of exemption this is a multistate form. If not enter the two-letter postal abbreviation forthe state under whose laws you are claiming exemption. To get started well just need your Home Depot tax exempt ID number.

17 hours agoThe deduction lowers both adjusted gross income and taxable income translating into tax savings for those making donations to qualifying tax-exempt organizations. 6 30 pm. Have your local Lowes store provide your Lowes customer ID or Lowes.

A purchase was made for a school by a person who used a different Tax Exempt other than our PTO. The risk is when you are not collecting a completely filled out exemption. Lowes s Tax Exempt number is 500277019.

Are you a tax exempt shopper. How do I get tax exempt at Lowes. In trying to set up our Treasurer Guidelines we ran across a situation that occurred last year.

Tracking Tax Exempt Purchases was created by Elmer. Once signed in click on my account in the top right corner of the search bar. View or make changes to your tax exemption anytime.

I need a form free purchases from Lowes in Arkansas business. Walmart Tax Exempt Program. The retailer can accept an exemption certificate with an agtimber number in good faith when selling the following items.

Select the appropriate state form below. Applying for Tax Exempt Status. Once you have followed the steps outlined on this page you will need to determine what type of tax-exempt status you want.

FOR OUR GOVERNMENT BUYERS WITH FEDERAL GOVERNMENT PURCHASE CARD 1. To get started well just need your home. Easily and securely access your invoices statements pay your bill and more.

Once youre approved shop in our stores or online and simply provide your tax ID at checkout to receive tax exemption on your eligible purchases. Walmart has a separate program for online and in-store purchases. Once signed in select my account in the top right corner of the search bar.

Complete Pennsylvania Tax Exemption Certificate form listed above and include Lowes Tax Exempt number 500277019. We assumed that this was a no-no told the. Sign in with the business account you will be making tax exempt purchases with.

Exemption for an entity-based exemption on a sale made at a location operated by the seller within the designated state if the state does not allow such an entity-based exemption. For general questions or to check the status of an order call Lowes customer care or the Pro desk. Organization name The University of Alabama Name of the primary purchaser Address Phone number.

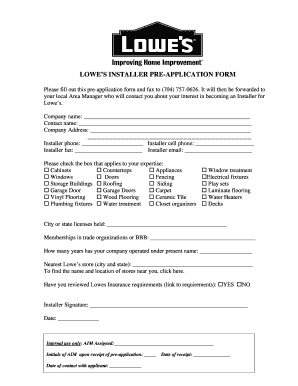

If you want to set up multiple users submit all of the required information below for each individual user. DESCRIBE PRODUCT OR SERVICES PURCHASED EXEMPT FROM TAX DESCRIBE PRODUCTS OR SERVICES PURCHASED EXEMPT FROM STATE TAX AND LOCAL. Individuals or businesses may qualify to make tax-exempt purchases.

Check if you are attaching the Multistate Supplemental form. As of January 31 2020 Form 1023 applications for recognition of exemption must be submitted electronically online at wwwpaygov. 7 Days a Week.

I need a form for tax free purchases from Lowes in Arkansas for equipment for agriculture business use. Click organization and then click tax exemptions. Use your key fob in store to save 7 on every purchase every day.

Proof of exemption for the states where the items will be shipped. Once signed in select Your NameAccount in the top right corner. So scan your 2021 credit card.

In the store you can present your state tax exempt paperwork at the service desk and they will provide you with a tax exempt card that you will present to the cashier PRIOR to starting check-out for future purchases. If you have a Federal Government Purchase Card no additional registration is required. Our Amazon Tax Exemption Program ATEP supports tax-exempt purchases for sales sold by Amazon its affiliates and participating independent third-party sellers.

No need to register. Select Sign In or Register in the top right corner. What are the hours for the Pro Desk at Lowes.

22242 satisfied customers. This was caught when they requested reimbursement. Get a Lowes Tax-Exempt Management System TEMS ID online or register at the ProServices desk at your local store.

Lowe S Proservices 5128 Escrow 2013 2022 Fill And Sign Printable Template Online Us Legal Forms

Tax Exempt Stores Who Honor The Tribal And Band Cards Posts Facebook

Lowe S Launches A New Powerful Pro Tool Lowesforpros Com Lowe S Corporate

Tax Exempt Stores Who Honor The Tribal And Band Cards Posts Facebook

Automate Your Lowe S In Store And Online Receipts

How Can I Get My Products Tax Free At Lowes Icsid Org

Lowe S Job Application Pdf Fill Out And Sign Printable Pdf Template Signnow

Lowe S Commercial Account Business Information

Lowe S Targets Industry Pros With New Marketing Campaign Builder Magazine